According to a recent survey of real estate investors, service firms and more by EY and the Urban Land Institute, 96 percent of real estate players see the future of work as more remote, while 85 percent think it will be more digital. Meanwhile, 85 percent expect artificial intelligence and business automation to increase.

The same survey found that at least 60 percent of employees are expected to spend 40 percent or more of their time working remotely, up from just 20 percent of employees being offered 20 percent remote working time pre-pandemic.

Technology spending is therefore expected to increase dramatically. Four out of five market participants are anticipating increased technology costs.

This emphasis on technology has grown in large part because of the disruption caused by covid-19. The pandemic has accelerated trends that were already underway, but it is no coincidence that the number one challenge identified by respondents to another survey of real estate industry leaders, by Heidrick & Struggles, was the digital and technological arena.

While ‘digital and technology’ was the most-selected challenge facing real estate, ‘digital and data optimization’ was seen as the greatest opportunity by only 29 percent. The biggest opportunity was seen as building new, sustainable, customer-centric business models. The fact that many more real estate leaders see technology as an area of challenge than as an area of opportunity may go some way to explaining why progress has not been faster.

Digital and technological disruption is not new. Clearly, it was significant even before covid-19, as a drive for efficiencies coincided with increased competition in the market in the wake of the 2008 crisis.

The ‘work from home’ revolution

The legacy of this year’s pandemic looks set to be a homeworking revolution. The revelation that employees can maintain productivity away from the office has clear implications for real estate.

A survey by PwC and the Urban Land Institute revealed only 1 percent of respondents disagreed that more companies will choose to allow employees to work remotely at least part of the time in the future. A full 94 percent agreed companies would, with more than half saying they strongly agreed.

The same survey found more than half of respondents strongly agreed that office tenants will require more square feet per worker than pre-covid levels in order to meet social distancing requirements.

Such findings are echoed elsewhere. The EY-ULI survey found participants expect shared workspaces to be popular, so coworking will be here to stay. Over half of respondents expect the majority of employees to work remotely.

Time to act?

With such sweeping changes anticipated, you would be forgiven for thinking that an unprecedented wave of tech investment was underway. In fact, investing has dropped. From little over $2 billion in 2015, real estate tech funding reached $5.4 billion in 2018 and $8.9 billion in 2019, but for 2020 was projected to reach just $8.4 billion.

The rapid growth of investment into proptech over the past decade can be largely attributed to firms and funds fearing missing out on an emerging trend. In the age of the new coronavirus, that trend has well and truly emerged, so the conversation has moved on to cutting costs and finding efficiencies rather than discovering the next game-changer.

Focus has shifted to solutions to ensure business continuity, such as video-conferencing tools and cloud technologies, and to customer engagement and sales tools, such as virtual tours that have become more interactive and include new formats as well as tenant engagement apps for the office and retail sectors. There are also tools to manage costs and efficiencies, either by monitoring buildings remotely or through project management software, as well as advances in construction technology.

Not all of these tools are typically thought of as proptech, but underline the importance of digitization as technology provides practical and immediate solutions to the challenges the market is facing.

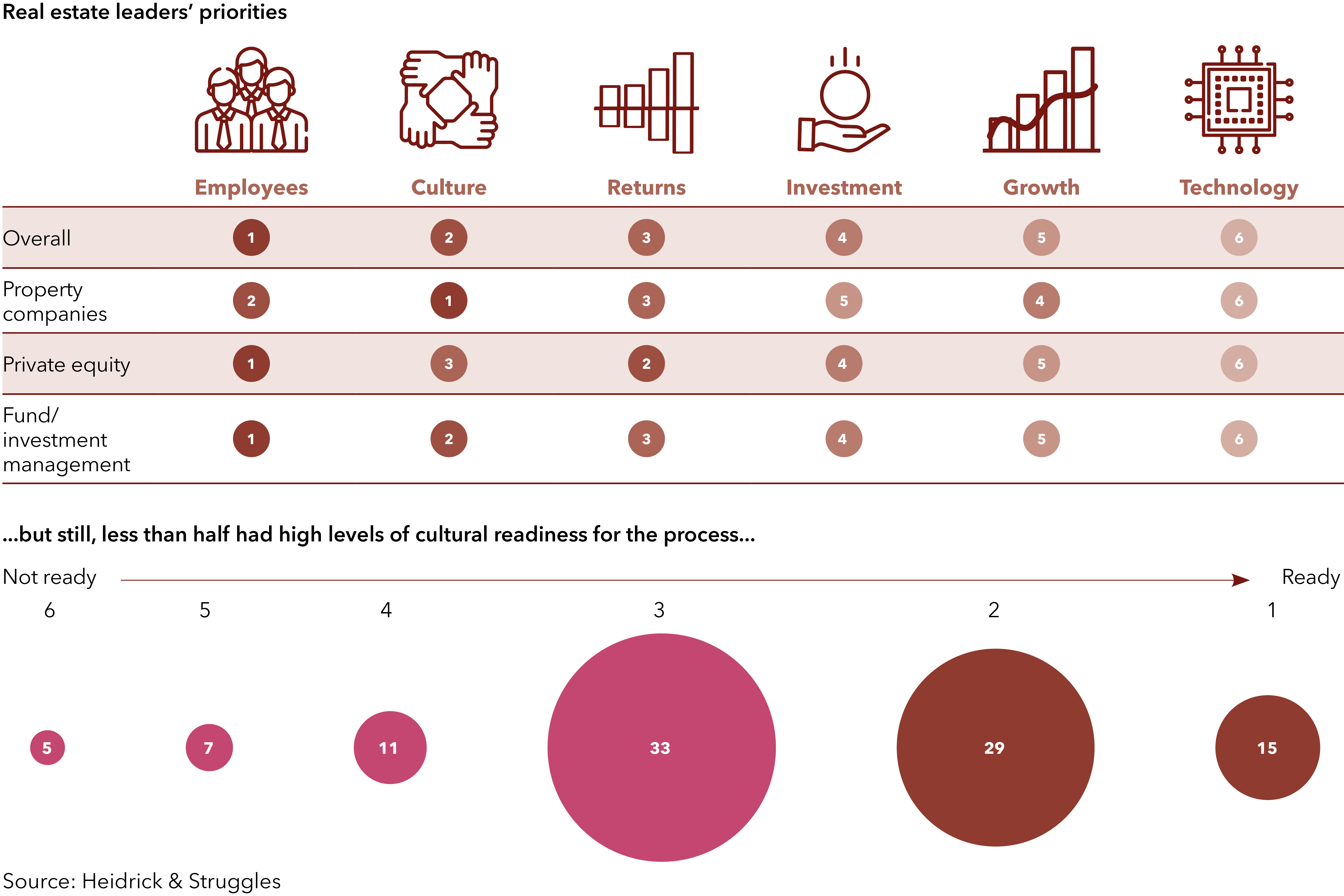

The Heidrick & Struggles survey found 83 percent of business leaders place a high level of importance on digital or technology in the future of their business, but that less than half had high levels of cultural readiness for the process. Despite this apparent lack of expertise or readiness for the digital future, only 1 percent of those asked said their firms were not keeping pace with – or outpacing – peers in their digital development.

This is despite the fact that, in a list of priorities comprising employees, culture, returns, investment, growth and technology, tech ranked sixth out of six for property company respondents, private equity respondents and fund or investment management respondents.

Considered and extensive technology strategies can improve efficiency and reduce costs. The automation of certain processes, the reduction of human error and the greater leveraging of data to make better investment and operating decisions can give firms a significant advantage, but the action being taken appears limited.

EY found that 61 percent of real estate firms have adopted some kind of technology, yet less than half of those (28 percent of the total) have adopted several products while the others (33 percent) have integrated only one or two. A further 35 percent are piloting, evaluating or assessing the market. The final 4 percent have not even thought about how tech can be applied.

This lag in adoption may be down to cost or return on technology investment, but more than half of firms EY asked said they lack the skills among staff to implement as much technology as they might like. The fact that new systems do not integrate easily into existing infrastructure and processes was cited by 58 percent, with 60 percent also saying competing priorities took precedence.

Thinking ahead

The expectations of employees and tenants may well be forever changed by this past year. The onus is on real estate firms to anticipate these changes and to act now, before they get left behind.

Real estate technology offers a wide range of solutions to the myriad challenges thundering over the horizon, not least by improving efficiency, controlling costs and identifying opportunities. While private real estate is alive to this fact, the sector has a significant amount of work to do to match not only the progress made in other industries, but the progress which participants themselves say that they want to see.

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email:

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email: