Climate risk in the real estate industry is often associated with droughts, floods, extreme heat and similar events. However, it is not solely comprised of physical factors but also encompasses transition or transitory risks that arise from the shift toward a low-emission economy.

The real estate industry is one of the largest emitters of greenhouse gases (GHG), accounting for approximately 38 percent of emissions, according to the IEA. Yet it is also one of the sectors with the greatest potential for reducing emissions, making the transition toward a GHG emission-free future profoundly influential for the industry.

The consequences of this shift are already observable in current markets, particularly in terms of price effects often referred to as the “green premium” or “brown discount.” These effects have become more apparent, especially with the recent slowdown in the transaction market in most parts of Europe.

The declining market attractiveness caused by the high emission intensity can be driven by both investor and tenant demand. While the energy crisis may have been resolved, stakeholders still remember the drastic impact that increasing heating costs can have and, therefore, move away from energy-intense properties.

Inaction can harm reputation

Nevertheless, escalating energy prices are not the only reason for investors to pull out of high-emission buildings. In a recent survey where we asked our stakeholders what their main drivers for an increasing focus on transition risk are, two other risks affecting the industry can be observed.

As awareness grows of the pivotal role real estate plays in the transition to a GHG emission-free economy, the pressure from NGOs and other public stakeholders intensifies. Stagnation in decarbonization efforts is viewed as a risk to a company’s reputation. Companies that lack tangible evidence of their commitment to achieving net-zero emissions can face accusations of greenwashing, highlighting the substantial impact of reputational risk on decarbonization decisions.

Be ahead of the regulatory wave

Not only voluntary net-zero commitments and the associated stakeholder expectations compel the industry to decarbonize the building stock, but also the uptake in sustainability regulations have put significant pressure on the industry. New energy efficiency standards, for instance, now require the retrofitting of high-emission buildings before they can be rented out.

While quantifying this policy risk and determining future regulations may seem daunting, we do have a clear target established in the Paris Climate Agreement. However, there exists a discrepancy between policies and pledges in place on the one hand and the commitment of well below 1.5C or well below 2C as outlined in the Paris Climate Agreement on the other.

According to the Climate Action Tracker, the independent project tracking different governments’ climate action, current policies result in a global warming of 2.6C, leaving a gap of approximately 1C, that is likely to be closed by future regulations. Therefore, to effectively manage transition risk, real estate companies must anticipate and proactively adapt to these forthcoming developments, ensuring to remain ahead of each new wave of regulation.

Quantifying and assessing transition risks

Carbon risk management tools such as the Carbon Risk Real Estate Monitor (CRREM) play a vital role in the identification and prioritization of transition risks. Within the broader context of risk management for commercial real estate, the process of quantification and assessment aids in understanding how transition risks compare to other systematic and unsystematic risks inherent in real estate investments.

CRREM streamlines the evaluation of potential financial impacts stemming from the gap between a property’s environmental performance and the CRREM decarbonization pathways, already aligned for a 1.5C ambition level. These considerations can then be integrated into strategic investment decisions at both the property and portfolio levels. To this date, approximately 20 percent of global institutional property stock has applied CRREM-resources in one way or another already.

The financial dimension of the risk stemming from the difference between the property’s actual energy/carbon performance and the CRREM pathway can be evaluated by taking into account various assumptions such as a direct CO2 price or increased costs associated with fossil fuels, which would be an indirect CO2 price. For properties designated for medium- to long-term retrofitting due to strategic considerations or because of building characteristics currently impeding immediate retrofit, direct or indirect CO2 pricing can be considered as a discounted negative cashflow until future alignment with the CRREM pathway.

It is important to acknowledge that not every property can reach the same level of ambition. A property that surpasses the CRREM pathways in terms of environmental performance should not be dismissed as worthless or become automatically excluded from potential acquisitions. Instead, the resulting transition risks, akin to other risks identified during standard due diligence procedures such as tax, legal or building technology assessments, should be adequately considered. This approach opens up new negotiation opportunities from an investor’s perspective.

Efficiency-first strategies

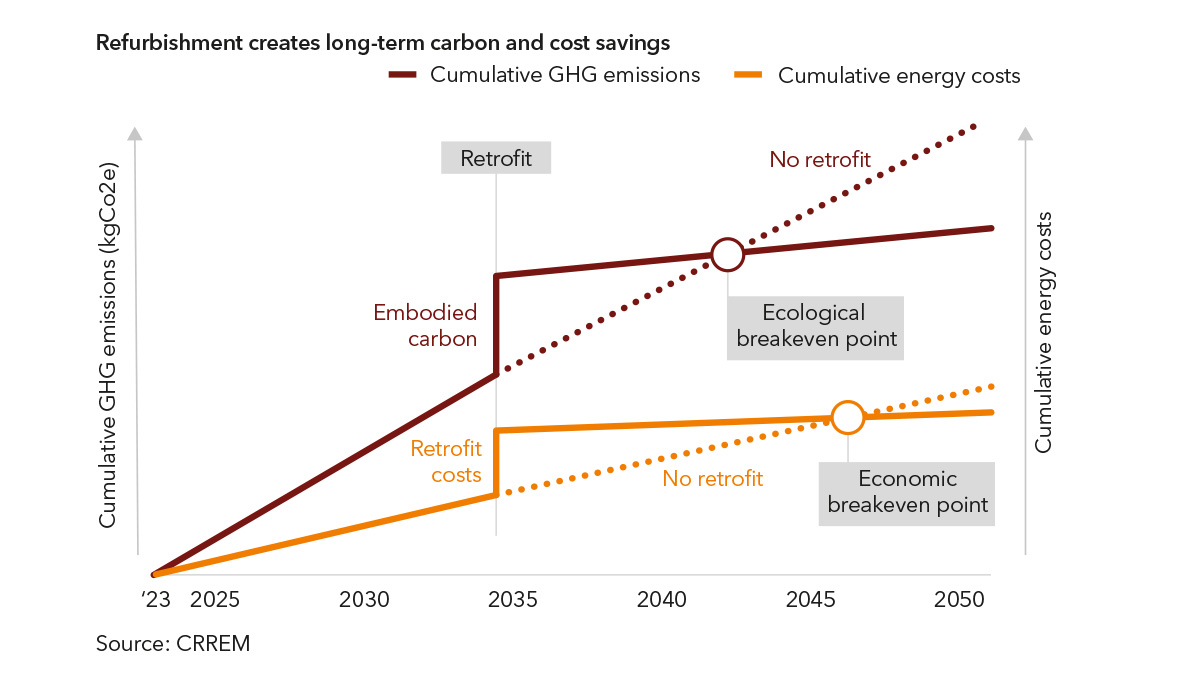

As 80 percent of the buildings that will exist by 2050 have already been built, the emphasis on the use phase becomes critically important. Extending the lifespan of existing buildings is essential to avoid additional emissions of embodied carbon, which have already been released in the past due to building materials. Naturally, economic viability takes center stage in every investment decision.

The goal of economic profitability should, therefore, be closely aligned with the imperative of meeting both current and future climate protection requirements. Taking a comprehensive view of returns over the entire property lifecycle allows for the integration of existing maintenance cycles and the realization of synergies.

Short-term considerations or investment decisions solely driven by return metrics, particularly those sensitive to cashflow timing, such as IRR, may underestimate medium- to long-term cashflow risks, as well as the potential benefits of green premiums in the form of increased rents and higher property values upon exit.

When defining objectives at the property or portfolio level, prioritizing “efficiency-first” strategies is essential for addressing transition risks. These strategies primarily focus on energetic retrofit measures and on-site renewable energy generation.

Not only does on-site renewable energy production have a significant positive impact on carbon emissions, it also provides the advantage of enhanced energy security while reducing the risk of future energy price increases. Transitioning away from fossil fuels towards electrified energy sources notably improves the property’s carbon footprint.

Given the limited rooftop space available for on-site renewable energy production, it is evident that the real estate sector cannot achieve net-zero emissions with existing technologies unless the power grid is also decarbonized. Nevertheless, within a decarbonization strategy, the procurement of green energy or carbon offsetting should only be considered as the final step towards achieving net zero once maximum efficiency and on-site renewable energy capacity at the property level have been realized.

Sebastian Leutner is an analyst at Institut für Immobilienökonomie (CRREM) and a doctoral candidate at the International Real Estate Business School, University of Regensburg. Ben Höhn is a research assistant and also doctoral candidate at the IREBS.

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email:

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email: