Jon Gray, president and chief operating officer of Blackstone, made his LinkedIn debut this week. He was welcomed to the platform with a celebratory post from the New York-based mega-manager’s chief executive and founder, Stephen Schwarzman.

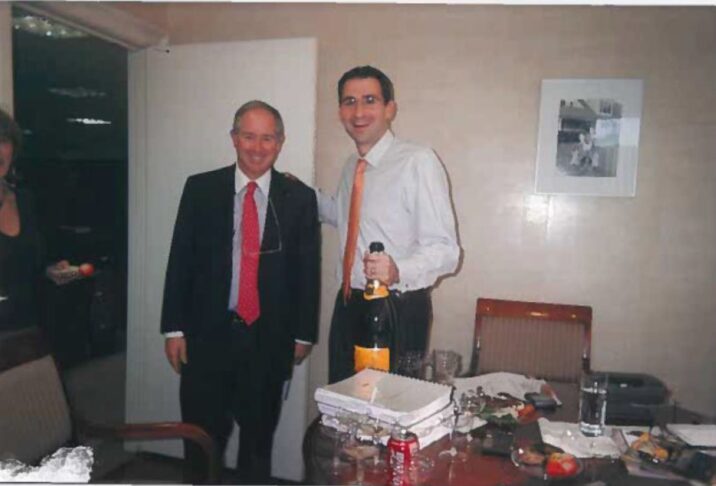

Schwarzman shared an old, grainy photo of the duo from the firm’s acquisition of Equity Office Properties in 2007 – and reminded investors about the speed, scale and return for its investors the $39 billion transaction presented. “In an eight-week span, we executed a total of $70 billion in real estate transactions – the initial purchase plus $30 billion of sales to reduce risk as much as possible for our investors,” Schwarzman wrote.

The post served as a timely reminder of what his firm was capable of the last time there was a generationally significant market reset.

The LinkedIn debut of Gray – who racked up 13,000 followers on his first day on the platform – also came with the promise of additional insights from the manager as Blackstone aims to communicate more directly through social media and, critically, through its leaders themselves alongside the firm’s corporate account.

To that end, PERE understands the firm has enrolled approximately 35 of its senior managers to get regularly posting, including real estate bosses Kathleen McCarthy and Ken Caplan, as well as Joan Solotar, global head of private wealth solutions, and Dwight Scott and Brad Marshall from Blackstone’s credit operations, among others.

Under the initiative driven by Christine Anderson, the firm’s global head of corporate affairs, and Alex Conner, its head of digital, followers can now expect these executives to post regularly from their personal accounts – compliance vetted, of course. The express aim, PERE understands, is to communicate via the individuals of the firm efficiently with its ever-swelling network of stakeholders and partners.

This more personalized form of communication is in keeping with other initiatives like the firm’s investor conferences, where capital partners come to participate in a series of interactive sessions wrapped around a central presentation program that more closely resembles TED Talks nowadays than the conventional, podium-style speeches of the past.

Will this personality-led communication drive catch on? The early perception is it could. Another example of a recent uptick in LinkedIn activity is at Blackstone’s New York neighbor KKR, whose global real estate head Ralph Rosenberg has become a more conspicuous presence since joining a month ago, posting thoughts at least once per week on the firm’s deals, awards and the views of his colleagues. Expect other senior industry leaders and the biggest managers to follow suit as they attempt to manage the narratives that matter most to their offerings.

A bigger question would be whether this strategic communication offensive would be happening if the financial markets were not in a state of flux and, in parts, turmoil. In the real estate context, this is particularly acute as the sector faces a generalized backlash in association with the US banking crisis and against a backdrop of sharply rising interest rates.

As a Blackstone senior executive told PERE of the firm’s LinkedIn use: “Now people are saying real estate is all one thing and all bad. We are here to tell you it is not all one thing and it not all bad.” Indeed, it was Caplan who notably positioned the firm in a post on LinkedIn in May in terms of how little exposed its equity real estate business was to US traditional office, the pariah sector of property which has dragged down the reputation of the broader market and, subsequently, become fashionable to visibly avoid.

Communication was sorely lacking in the aftermath of the last global financial crisis of 2008, with many institutional investors complaining about a lack of transparency on performance. Whatever suboptimal behaviors transpire from this current crisis, Blackstone, KRR and their peers are endeavoring to ensure communicating what investors and other stakeholders need to know is not among them.

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email:

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email: