This article was sponsored by LaSalle Investment Management. It appeared in the ESG Investor Survey, a sponsored supplement appearing alongside the July/August 2019 issue of PERE magazine.

The real estate investment sector, both private and public, is in a period of ESG evolution with institutional investors and managers determining the actions they will need take over the short, medium and long term to address climate change. We are all driven by the Paris Agreement goal to keep the increase in global average temperature to well below 2C above pre-industrial levels and to limit the increase to 1.5C. The actions required are broad, from redlining geographical areas due to physical climate risk to hardening physical property assets to make them more resilient, from implementing retrofits to reduce onsite consumption at assets to offsetting carbon emissions through renewable energy credits and virtual power purchase agreements, from creating green spaces at the properties we own to engaging with our tenants. Our industry has an obligation to think about these issues beyond today.

ESG in the investment strategy

Investors of all types, public REITs, consultants and private investment managers, recognize the need to price ESG factors into the investment thesis. At LaSalle Investment Management, we undertook a detailed exercise with our parent company, JLL, to identify the UN Sustainable Development Goals (SDGs) that are most material to our business. Following guidance published by the Global Reporting Initiative, the UN Global Compact and the World Business Council for Sustainable Development, we mapped the value chain impacts of the SDGs. This exercise has enabled us to understand the most significant upstream and downstream impacts on our business and from that to prioritize the actions where we have the greatest potential to make a positive contribution and to mitigate any negative impacts.

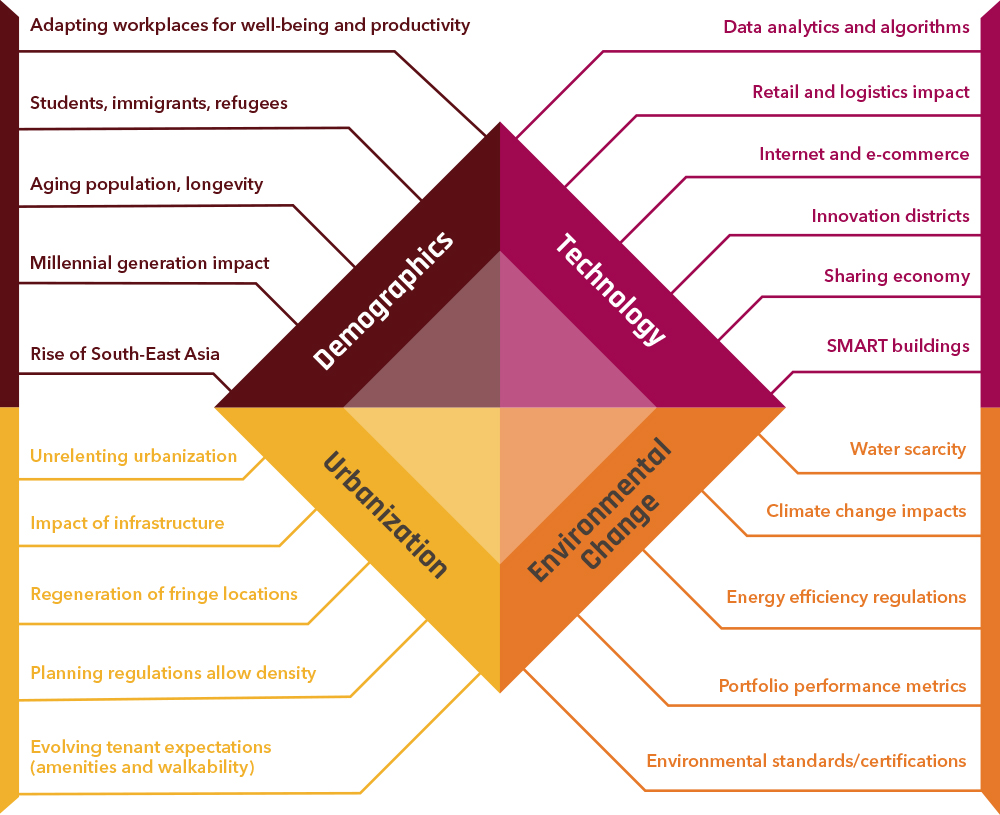

As such, we added environmental factors to our investment strategy to form the Demographics, Urbanization, Technology + Environmental Change program, which is our map of the megatrends and demand drivers in the current real estate market that are influencing investment decisions. We did this given our belief that multiple environmental issues will exist as long-term demand drivers, which must be considered for all acquisitions as a fiduciary to our investors. In conjunction with the social issues we already recognized through the lenses of demographics and urbanization, adding these environmental factors rounded out ESG in our investment approach. Through this work, we have the opportunity to capture a ‘green premium’ by improving the ESG credentials of the assets acquired and managed by LaSalle Investment Management.

The connections between the six SDGs we consider material and our investment strategy are clear. SDG 13 on Climate Action aligns to climate change impacts in our Environmental Change pillar in the DTU+E; SDG 7 on Affordable and Clean Energy ties in to our Technology pillar and energy efficiency drivers in our Environmental Change pillar; and our pillars of Demographics and Urbanization tie into SDG 3 Good Health and Well-Being, and SDG 8 Economic Growth and SDG 11 Sustainable Cities.

Developing an eco-system of stakeholders

Private investment managers cannot meet global ESG and sustainability goals alone, so, in 2017, we developed a framework, which we called the ‘Eco-System of Stakeholders.’ Reflecting on this framework, there are clear ties to ESG factors that have become even more prominent today, almost two years later. The work being done by The Taskforce on Climate-Related Financial Disclosures (TCFD) has since both formalized and socialized the terminology being used to discuss climate change risk to the associated physical and transition risks. Perhaps we were a bit ahead of our time before this teminology became commonplace.

Physical climate change risks in the eco-system:

- From a tenant’s perspective, climate change is a factor to consider for enterprise risk management and disaster recovery planning;

- The insurer’s perspective begins to quantify the potential financial impact that physical climate change risks – floods, wind, wildfires, earthquakes, droughts – have on insured portfolios. We even identified the need for insurers to further develop models and applications to supplement traditional pricing practices based on historical loss experiences;

- Neighboring market perspective: disaster preparedness plans that make a property and an entire district more resilient to extreme weather events.

Transition climate change risks in the stakeholder eco-system:

- The regulator’s perspective is driving transition risk, as government-driven ESG initiatives are increasing both on a national and local scale in order to reduce carbon emissions;

- Neighboring market perspective: voluntary efforts in local communities – farmers’ markets, ride-sharing, bike-sharing, for example – often promote sustainability and healthy living and are initiatives that extend beyond the perimeter of a single building, thereby reducing the carbon footprint of an entire district.

As a property owner in the lens of this framework, investment managers like LaSalle Investment Management must be both proactive and reactive to both physical and transition climate risks. In order to be proactive, we continue to participate in the United Nations Environmental Programme – Finance Initiative pilot project on implementing the TCFD recommendations externally, leveraging this work to further ESG in our investment strategy and to develop our house approach to pricing climate risks.

How ESG factors interact

ESG covers a broad set of objectives, as evidenced in the results and perceptions from the survey. When LaSalle Investment Management added environmental factors to its house investment strategy to form DTU+E, we recognized that sustainability, and even the acronym ESG, is often understood to only apply to environmental issues. While investment managers and investors alike would agree that environmental factors are the most likely to influence investment returns, this is due to the fact that environmental factors are the easiest to quantify. A building with gross leases that implements an LED retrofit potentially reduces utility expenses by $50,000 annually. Capitalized at 5 percent, this is a $1 million addition to that asset’s valuation. While this is easier said in this simple example than achieved in reality, it has been a great driver of environmental investments in real estate.

However, across the eco-system of stakeholders, we need to address environmental, social and economic factors in order to endure and hopefully thrive in the long term, and certainly in the face of the long-term economic risks posed by climate change. These may feel like disparate categories to group together, but by overlaying these three elements onto the search for strong investment returns, the concept of responsible investment becomes clear.

Effectively, in order for an investment to perpetuate in the long term, the impacts of that investment activity on both the environment and on society must be positive, while providing market rate returns. Given that most institutional investors – pension funds, endowments, insurance companies – hope to serve their participants and clients over the long term, this is clearly a sensible business decision to be making today to protect future returns and asset values for tomorrow.

Investors as drivers of ESG

Turning our focus to investors and the intent behind this ESG Investor Survey. As a fiduciary to our investors, long-term value creation and protection is fundamental to our business and we believe that ESG best practices can enhance returns. We are seeing investors all over the world, especially in Europe and coastal US areas, asking new and deeper questions demonstrating their increasing knowledge of the subject and their growing involvement in industry ESG initiatives.

Investors are asking us to expand our horizons in this area and take a greater leadership role, so we continue to define our impact on climate change, identify opportunities for building-level resilience initiatives and explore the newest trending area of impact investing.

At LaSalle Investment Management, we remain focused on being a leader in this evolving ESG landscape through continued integration of best practices across our businesses. Through this survey, we have validated that focus, with 95 percent of the respondents indicating they believe that ESG principles have a role to play in making investment decisions. Our aim, as a manager, is to help investors think about efficient ways to better analyze, price and integrate ESG factors into the risk-return evaluation of each asset. We are thinking beyond today for our planet, society and investment performance.

Clean energy in LaSalle’s European portfolio

In Germany and the UK, 100 percent of our energy is procured through contracts with energy obtained from renewable sources.

We regularly review our portfolio for opportunities to install solar panels on the roof space of our assets with the objective of generating energy on site for use by the tenants. This has the triple benefit of reducing the carbon emissions of the asset, providing cheaper electricity for our tenants and providing energy security.

We have installed rooftop photovoltaic panels at five properties in the UK totaling 523kw, generating over 770,000kwh on site annually. These installations produce positive returns for our clients’ assets from the income they generate. LaSalle Investment Management has implemented this initiative at assets across its global portfolio and continues to seek additional opportunities.

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email:

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email: