This article is sponsored by Macquarie Asset Management

Globally, strategies focused on industrial, rental housing and select niche investments are expected to continue to show growth and resilience through cycles supported by stable cashflows and strong fundamentals. However, despite the likelihood of capital inflows remaining high, particularly if spreads to government bonds remain at current levels, overall performance is likely to be lower than in previous recovery cycles.

In the office sector, we are likely to see increasing flight to quality and obsolescence as occupiers and investors implement strategies to achieve their long-term net-zero carbon emissions targets.

Net-zero carbon office developments and refurbishments in expensive gateway markets are likely to become more evident as are investments to reduce the operational carbon emissions of existing buildings, such as logistics facilities, supermarkets and retail warehouses.

Over the longer term, net-zero carbon properties are likely to command increased focus if, as is expected, institutional investors and traditional bank lenders shift their portfolios away from standard investments.

Costly and difficult to upgrade secondary assets are likely to create opportunities to repurpose existing real estate into alternative uses.

Here are eight key themes defining the current real estate investment landscape.

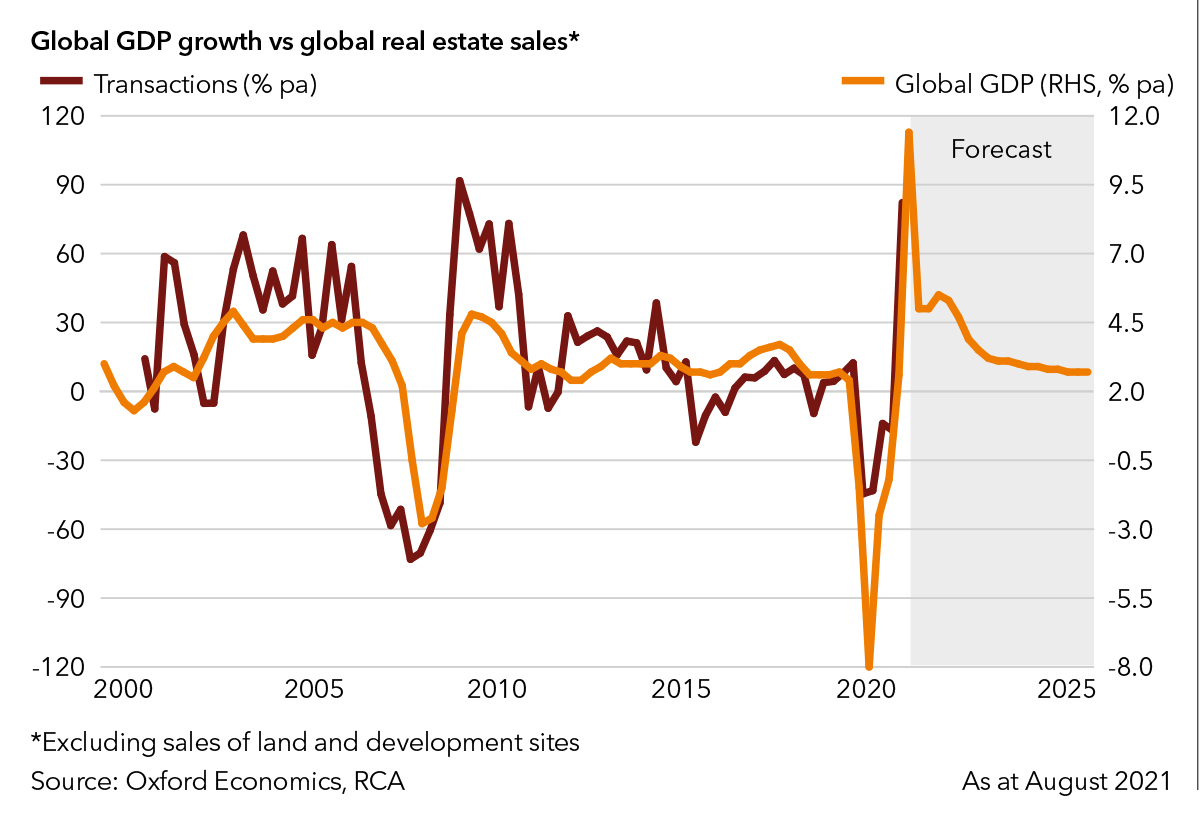

1. Global macro outlook remains robust, despite a Delta surge

The global economy has recovered swiftly over the past 12-18 months and exceeded most forecasters’ expectations, with the level of GDP now back above its pre-covid level in Q2 2021 supported by a strong consumer spending revival, particularly in the US.

Labor markets have tightened sharply in many markets, which has supported a recovery in property fundamentals and transactions. This is particularly evident in core sectors such as industrial and rental housing and other niche asset classes where demand has remained resilient.

While global growth is expected to remain above average in H2 2021 and into 2022, supported by elevated household savings and strong asset pricing recovery, including housing, Q2 2021 is likely to mark the peak in the growth recovery this cycle.

For example, leading growth indicators – such as the global manufacturing Purchasing Managers Index (PMI) – have rolled over in recent months as the recent surge of the Delta variant of covid-19 impacts global supply chains and inventory restocking efforts of advanced economies.

As has been the case for the past 18 months, covid-19 remains the biggest risk to the ongoing economic and real estate recoveries, particularly as Delta cases surge in many markets.

2. Booming housing markets fueling rental demand

While housing was a big drag on the global recovery following the global financial crisis, it is currently booming in major developed markets, with large positive benefits to the rest of the economy, including construction, household balance sheets and consumer spending.

The highly synchronized global housing upswing – supported by historically easy monetary policy and limited banking distress – is pushing up prices relative to incomes, making it even more difficult for young people and lower income households to scrape together a home deposit.

With potential first-time buyers renting for longer or locked out of home ownership altogether, aggregate demand for rental housing has remained strong, though demand has shifted somewhat toward regional markets and US sunbelt metros.

In the case of major gateway markets, such as New York, housing demand is recovering quickly though, as young people flock back to cities for jobs, education and lifestyle reasons.

Broad measures of housing rents, which are incorporated into national Consumer Price Indices, have stabilized this year, following a slowdown last year.

Rental growth is expected to accelerate as vacancy rates tighten further and wage growth recovers in many markets supporting housing cashflows and revenues.

To some extent, rental housing in the US, UK and Australia may benefit from any sustained inflationary pressures over the medium term given rents can be reset annually.

Of course, policy tightening in response to high inflation may trigger slower employment growth, which would also have knock-on impacts to real estate demand, including in housing.

Regulatory risks also remain elevated in some European and US cities as rental affordability disproportionately impacts key workers and low-income households.

3. Unprecedented industrial demand brought forward by covid-19 disruptions

In the industrial sector, similar trends can be observed across the world where demand for space in and around large consumer populations and well-connected secondary cities is at historical highs.

Strong global online sales growth projections at around 10 percent per annum over the next decade, more than double overall retail spending, are expected to underpin demand for space. This should help to offset ongoing productivity gains as occupiers move into modern facilities and supply rises in some markets.

Medium-term demand may be further boosted from the following:

- inventory restocking as importers look to rebuild their supplies following covid-19 disruptions;

- a shift from ‘just-in-time’ to ‘just-in-case’ inventory management where more stock is held in storage for a given level of sales; and

- potential near-shoring production efforts to diversify supply chains, particularly pharmaceuticals and other daily essentials.

To a certain degree, these factors will help to offset the switch back to services consumption as policy stimulus fade and housing markets normalize.

4. Strong focus on institutionalizing asset classes

Occupier and capital demand for niche asset classes, such as data centers, life sciences facilities and innovation hubs, remain strong.

These sectors were inevitably going to be supported by key global structural shifts including increased use of technology, data flows and an aging demographic.

But the nature of a health pandemic, which has boosted research and development spending and facilitated shifts toward remote working and home entertainment, has brought forward the demand adjustment that was already taking place but at a slower pace.

To a certain degree, the lack of pricing discounts and distressed assets that were evident in past downswings has meant that investors remain focused on alternatives.

Strong investor demand and capital flows are bringing forward the institutionalization of these asset classes and pricing is adjusting accordingly.

5. Focus on high-quality space, given growing ESG considerations

In other core sectors, although pricing has generally stabilized, demand for space remains highly selective across markets and segments.

Leading indicators including Europe’s PMI composite indicator and US office-based jobs growth, for example, point to a cyclical demand recovery in the office sector.

However, many large corporates remain uncertain about their future spacing requirements, which is delaying a swift office market recovery, though leasing activity is picking up for smaller tenants as they take advantage of attractive incentives available.

However, many large corporates remain uncertain about their future spacing requirements, which is delaying a swift office market recovery, though leasing activity is picking up for smaller tenants as they take advantage of attractive incentives available.

While most large tech firms appear to be leaning toward a hybrid working model, these businesses should continue to grow faster than overall economies, supporting demand over the medium term.

Overall, the office sector is exposed to significant disruption over the coming decades, creating opportunities to develop high-quality space that caters to the growing importance of tech-savvy millennials in the workforce and increasing use of technology in workplaces.

Broader ESG considerations will also play an important role as many occupiers and investors – led by developed markets – target their real estate portfolios and corporate footprints to achieve net-zero carbon targets over the coming decades.

6. Global transactions recovery well under way

Real estate investment and liquidity have bounced back sharply this year, consistent with the shape of the global economic recovery over the past 12-18 months.

Transactions reached $420 billion in H2 2021 with sales volumes increasing by more than 80 percent year on year from Q2 2020 lows, according to Real Capital Analytics.

Globally, total investment for the first six months of 2021 was just 10 percent below the three-year pre-covid average, although the sector split has changed substantially.

Purchases of apartments ($126 billion) exceeded the office sector ($122 billion) for the first time in H1 2021, reflecting a theme that has been evident for some time now as investors shift toward real estate that is less exposed to cycles.

To some extent, office investments should pick up as liquidity returns to gateway markets, particularly in those cities that were severely impacted by covid-19, such as New York.

7. Cyclical liquidity recovery led by the US, UK, and Australia

The US market has led the global upswing with transaction volumes increasing by 40 percent in H1 2021 relative to the first half of 2020. US volumes are now back to pre-covid averages.

More modest recoveries of 4 percent in Europe and 13 percent in Asia-Pacific have been recorded, though transactions in these regions held up relatively better in the early stages of covid-19, supported by a few large transactions.

In Europe, a strong investment recovery has been seen in the UK – 47 percent higher in H1 2021 vs H1 2020 – supported by the speed of its vaccination rollout and economic recovery this year, with North American investors particularly active.

In the Asia-Pacific region, Australia has seen a strong bounce with H1 2021 transactions 59 percent higher than prior year levels. Investment continues to be supported by Asian and European cross-border investments into the industrial sector and CBD office markets.

8. Tug of war between Delta and vaccines

The near-term economic and property outlooks are likely to be decided by the tug of war between Delta (and other new covid-19 variants), roll-out of vaccines in lagging markets and booster shots in leading markets, as the effectiveness of vaccines appears to wane over time.

Overall, we would expect to see a catch-up next year in markets where demand is currently being impacted due to delayed vaccination roll-outs and low tolerance for new covid-19 cases, including many in the Asia-Pacific region, such as Australia.

For those markets where there are high levels of immunity due to high vaccination rates and prior infections – such as the UK – the economic impacts of the Delta surge are likely to be limited and unlikely to result in any substantial tightening in restrictions.

Further out, premature withdrawal of policy stimulus, including tapering of asset purchases by central banks and eventually increases in cash rates, remains the key risk for a sustained recovery over the medium term, as it has been in previous property cycles.

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email:

If you do not receive this within five minutes, please try to sign in again. If the problem persists, please email: